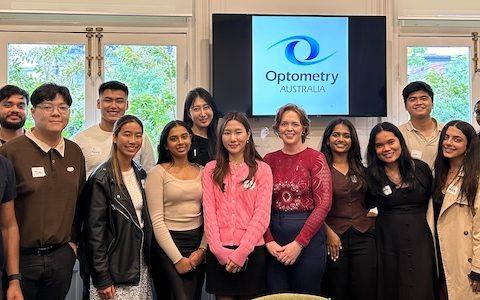

Leadership program leaves optometry students inspired and empowered

The 2024 Student Leadership Program, which ran from 13 March to 10 April, brought together a diverse group of 18 students from across Australia and New Zealand, eager to enhance their leadership skills and make a difference.

Tagged as: Students