1:30min

By Rhiannon Riches

Assistant Editor

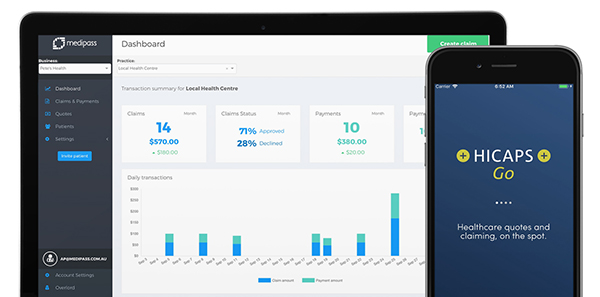

HICAPS is going mobile. The new digital platform, currently live in selected allied health practices, connects patients to practitioners and health funds in real time.

National Australia Bank (NAB), which owns HICAPS, is working with health-tech start-up Medipass Solutions to create a digital extension of HICAPS called ‘HICAPS Go’, which makes it easier for patients to find health-care practitioners including optometrists, estimate out-of-pocket costs for a consultation ahead of time, make an appointment, and pay or make a claim on the spot.

HICAPS says HICAPS Go reduces administration needs and simplifies the payment process for health practitioners, eliminating the need for patients to pay the whole bill up front and then recoup the benefit from their health fund.

For health funds, it reduces claim processing overheads, simplifies payment and claiming functionality, and improves fraud controls.

NAB’s Executive General Manager Digital and Innovation, Jonathan Davey, said the platform

delivered a seamless and transparent experience for patients, practitioners and health insurers, through a digitally integrated platform.

HICAPS Go is initially focusing on allied health and launched in October 2017 to physiotherapists, chiropractors, osteopaths, podiatrists and myotherapists. Mr Davey said the team was working quickly to add more practitioners and to extend the service to more health funds beyond Medibank, which has been assisting with development to date.

According to HICAPS, physiotherapists participating in the pilot have said the speed of finalising payments is delivering new efficiencies.

HICAPS is consulting optometrists in the development of the complex platform for optometry, and is looking to launch the service for optometry in early 2018. HICAPS is inviting optometrists and dispensers to register interest in the trial. For more information visit www.hicaps.com.au/go.